The Weinstein Company declared bankruptcy. Fox News reported a special $50-million line item in its financial statements for settlement of claims. Fortune 500 companies are spending an average of $14 million a year on harassment-related costs. Many other businesses across North America are facing the steep cost of looming litigation and settlements for those who have been sexually harassed in the workplace.

For those who doubt the risks and hard costs attached to moral jeopardy, company balance sheets—and the impact of potential settlements on share price—tell a stark story. That said, it’s a story that does not begin to quantify the soft costs, such as brand and reputational damage, high rates of absenteeism and turnover, productivity loss and the long-term impact that employee mistrust has on morale.

More than ever before, there is public scrutiny of and pressure on management to ensure that the right policies and processes are in place to prevent sexual harassment and, where it does occur, to deal with it in a swift, transparent and decisive way. Business leaders must not only do the right thing, they must be seen doing it.

No such measures will be effective, however, unless they are based on research and as much information as can be gathered. To that end, Navigator has conducted a national online survey to establish baseline data for Canadian decision-makers.

Here are the key findings to this survey report:

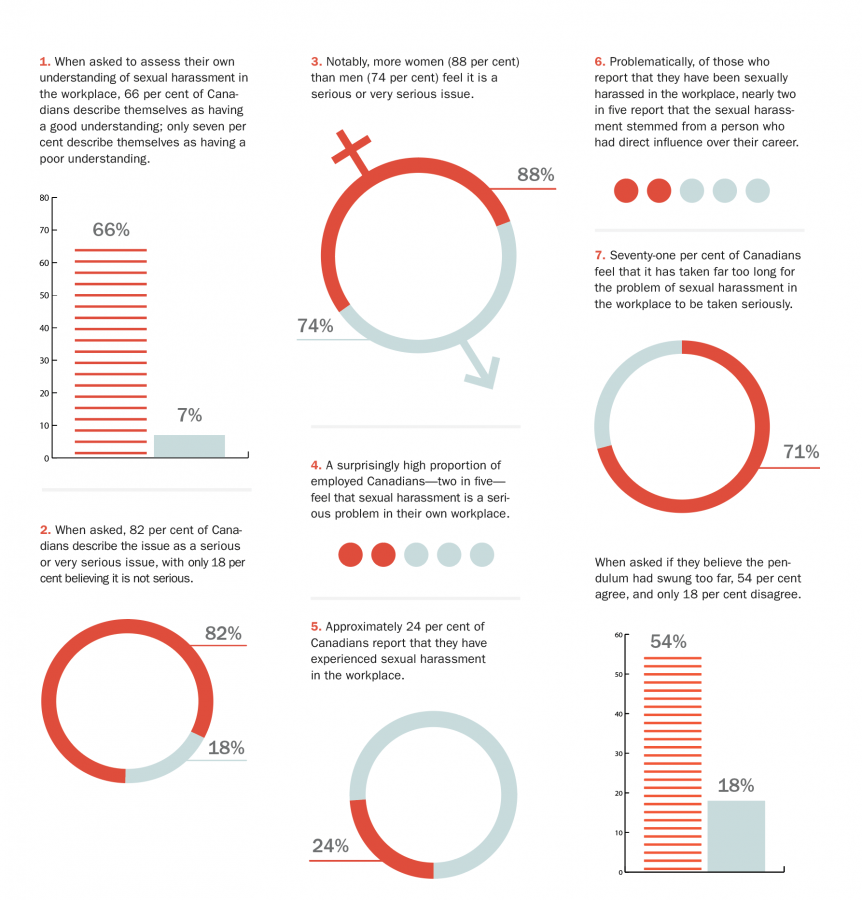

- When asked to assess their own understanding of sexual harassment in the workplace, 66 per cent of Canadians describe themselves as having a good understanding; only seven per cent describe themselves as having a poor understanding.

- When asked, 82 per cent of Canadians describe the issue as a serious or very serious issue, with only 18 per cent believing it is not serious.

- Notably, more women (88 per cent) than men (74 per cent) feel it is a serious or very serious issue.

- A surprisingly high proportion of employed Canadians—two in five—feel that sexual harassment is a serious problem in their own workplace.

- Approximately 24 per cent of Canadians report that they have experienced sexual harassment in the workplace.

- Problematically, of those who report that they have been sexually harassed in the workplace, nearly two in five report that the sexual harassment stemmed from a person who had direct influence over their career.

- Seventy-one per cent of Canadians feel that it has taken far too long for the problem of sexual harassment in the workplace to be taken seriously. When asked if they believe the pendulum had swung too far, 54 per cent agree, and only 18 per cent disagree.