IN CANADA, we have seen the issue become the focus of a broader public debate under both the previous Conservative government of Stephen Harper and the current Liberal government of Justin Trudeau. For Harper, the issue was Chinese state-owned CNOOC Ltd.’s acquisition of Nexen; for the Trudeau government, it was the sale of Canadian satellite technology firm Norsat International to Hytera, a Chinese communications firm.

Public debate typically raises concerns about national security, sovereignty, environmental standards and labour laws. Public trust is also undermined by approval processes that take place behind closed doors at the federal cabinet table.

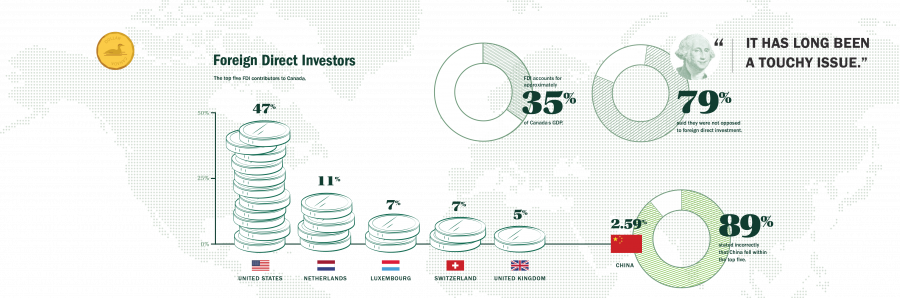

However, the debate often misses the point that Canada needs foreign investment and always has. In fact, Canada has been built by foreign investment, in many ways. Canada is a large country with a relatively small population; we simply don’t have the domestic financial resources to fully tap our immense potential.

The public assumes that foreign direct investment is an issue mainly in the resource extraction sector, but this is not the case. In 2016, the manufacturing sector in Canada led all other industries in foreign direct investment at 28 per cent. Overall growth last year in this type of investment occurred across most industries, led by wholesale and retail trade (10.1 per cent growth), manufacturing (5 per cent) and mining and oil and gas extraction (3.2 per cent), according to tradingeconomics.com.

Foreign direct investment is a practical necessity for continued growth

At a time when world powers like the U.S. and China are looking inward economically, there is opportunity for Canada. U.S. President Donald Trump’s “America first” approach and China’s new regulations restricting “irrational” overseas investment by Chinese interests may seem threatening in the near term. However, the slowing of foreign capital investment may focus Canada’s approach to global trade.

The rest of the world is looking to Canada not only for the opportunities we offer, but also because of our relationship with these two global powers and our access to their markets. Additionally, the new global dynamic may mean new opportunities for bilateral trade agreements that can establish clearer rules for foreign direct investment, and can lead to new sources of capital for Canadian industries to access. One only has to look to such things as the Canada-EU trade agreement, Brexit, continued dialogue with China and India, and the renegotiation of NAFTA to see where that potential may come.

That doesn’t mean that Canada should abandon its values. Some things cannot be compromised, including national security, environmental and labour protections and other things that benefit Canadians.

However, rather than playing politics with approvals or allowing the perception of clandestine decision-making processes to prevail, governments should focus on developing and enforcing protections that Canadians can have confidence in.

Despite the public discourse that has occurred with recent transactions, foreign direct investment does not mean the sale of Canada’s natural resources or state secrets to foreign countries. The federal government must be proactive and transparent about the laws and regulations that will be applied to protect Canadian interests.

To fully develop its economic potential, Canada should seize the opportunity to be a place in which the world wants to invest.