Premier Doug Ford won a third consecutive mandate after calling an early election more than a year ahead of schedule. Riding the high of his alter ego, Captain Canada, Ford successfully positioned himself as the leader best prepared to protect Ontario from the threat of U.S. President Donald Trump’s tariffs. Speaking at his victory party, Ford said he needed “a strong mandate that outlives and outlasts the Trump administration. A mandate to do whatever it takes to protect Ontario.”

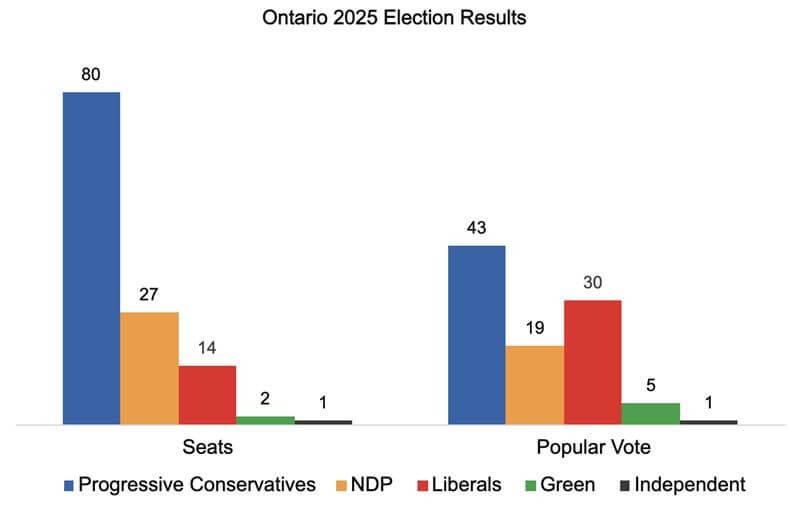

In the end, the PCs claimed 80 seats, and the NDP held onto their role as Ontario’s Official Opposition with 27 seats, while the Liberals regained official party status, picking up 14 seats. The Ontario Greens retained their two seats in the Legislature.

The Ontario Liberals successfully flipped four seats, gaining ground in Nepean and Ajax, and winning in the historically Liberal riding of Toronto—St. Paul’s, which the NDP have held since 2018.

Liberal Leader Bonnie Crombie lost in her own riding of Mississauga East-Cooksville but promised to stay on as leader in her concession speech.

Voter turnout surpassed the last election, with 45 percent of Ontarians casting ballots.

New Government Mandate

Cruising to victory with a rare 3rd consecutive majority, Ford has secured another four-year term. With a strong mandate from the people of Ontario, Ford will view these results as an explicit endorsement of his platform, which he laid out the details of earlier this week. Look for Ford to prioritize the following initiatives throughout the early stages of the new parliamentary session:

- Protecting Ontario from tariffs: Ford earmarked nearly $20 billion to combat the likely impact of these penalties on Ontario businesses.

- Removing interprovincial trade barriers: The PCs promised $50 million to a new Ontario Trade Together Fund supporting Ontario businesses’ ability to expand into other provinces.

- Supporting our security: They committed to prioritizing investments in defence spending and border security, speaking directly to Trump’s criticism of Canada’s contributions to NATO.

- Investing in Infrastructure: The Conservatives plan to add an additional $5 billion to the Building Ontario Fund to build more LTC homes, housing units and transportation infrastructure, potentially including Ford’s wildly controversial 401 tunnel.

- Hurrying up Hubs: Lastly, expect Ford to prioritize keeping his promise to open the province’s 27 new HART Hubs by April 1, 2025, his $530 million alternative to the Supervised Consumption Sits currently operating in the province.

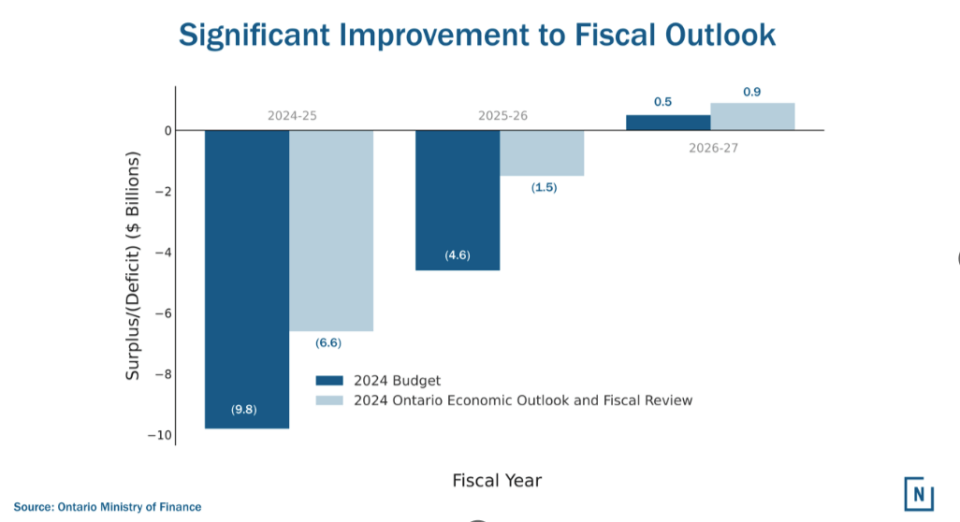

If you think all of this sounds like it costs a lot of money, that’s because it does. Ford’s platform calls for $40 billion in new government spending, leaving some to question the Premier’s promise to balance the budget by next fiscal year. Only time will tell if a new spending blitz will be enough to push back on incoming U.S. tariffs and keep Ford’s promise to protect Ontario.

Official Opposition Platform

NDP – More of the Same

While they were hoping for a more decisive result, yesterday could have gone worse for the NDP. Ontario’s Dippers managed to hold on to all of their incumbents in the province’s Northern ridings, which the Conservatives heavily targeted. They also managed to keep most of their urban seats in the province held by an incumbent, only losing Toronto-St. Paul’s to the Liberals.

Ironically, the NDP seemed to receive the same message as Ford’s victorious PCs from Ontario voters: more of the same, please. As the Official Opposition, the NDP now have a renewed mandate to hold the PCs to account, on cornerstone issues like healthcare, housing and affordability.

However, one question remains: leadership. While Marit Stiles won her seat handily, she didn’t perform any better than previous NDP bosses, which could be grounds for dismissal if the party is ambitious. However, given the short election period and her party’s Opposition status, expect Stiles to be granted some leniency and stay on as party head until at least the next election.

Liberals – Bonnie in Two?

Despite campaigning on winning in one election, Liberal Leader Bonnie Crombie moved her own goalposts for the snap election call. She had three things she needed to accomplish:

- Win official party status (12 seats)

- Move into official opposition

- Win her seat

Unfortunately for her, she only managed to accomplish one of the three, securing official party status, and all the benefits that come with it for her beleaguered party. Outside these goals, she failed to deliver seats in Mississauga and much of the vote-rich 905.

Will party status be enough to keep the naysayers at bay, giving Crombie a second shot, or will the knives start to turn inward?

Close Races, Fresh Faces

While the legislature’s composition remains largely the same, this less-than-eventful election did bring us a few tight races and fresh faces. Here are the new talking heads we’ll be seeing in the next legislative session:

- Etobicoke—Lakeshore: Liberal’s Lee Fairclough picks up over PC’s Christine Hogarth.

- Hamilton Mountain: Monica Ciriello gains, marking the PC’s first victory in the riding since 1999. The riding was long held by NDP MPP Monique Taylor, who is looking to make her move into federal politics.

- Hamilton Centre: Robin Lennox (technically) reclaims the riding for the NDP. It was previously held by Sarah Jama, who sat as an independent after being ousted from the same party.

- Algoma—Manitoulin: PC’s Bill Rosenberg beats out independent incumbent Michael Mantha, who formerly sat with the NDP until 2023. The PC’s first victory in the riding since 1987.

- Toronto—St. Paul’s: Liberals reclaim historical stronghold. Former CP24 anchor Stephanie Smyth gains over prominent NDP incumbent Dr. Jill Andrew.

- Don Valley North: Liberal candidate Jonathan Tsao gains over PC’s Sue Liu.

- Ajax: Liberal’s Rob Cerjanec narrowly pulls from PC incumbent Patrice Barnes.

- Nepean: Liberal candidate Tyler Watt flips after longtime PC incumbent Lisa MacLeod announced her exit from provincial politics.

Too close to call

Politicos will still be watching out for local recounts and potential flips as counting continues. Here are the races where it may be too close to call:

- Burlington: PC incumbent Natalie Pierre leads over Liberals by 40 votes.

- Mississauga—Erin Mills: PC incumbent Sheref Sabawy leads over Liberals by 20 votes.

- York South—Weston: PC candidate Mohamed Firin leads over Liberals by 44 votes.

- Mushkegowuk—James Bay: NDP incumbent Guy Bourgouin leads over PCs by 4 votes.

Have any questions about the Ontario election? Please reach out to our political experts at info@navltd.com.