- CEOCap

- Jaime Watt’s Debut Bestseller ‘What I Wish I Said’

- Media Training

- The Push Back

- Internship program

- Update Your Profile

- Homepage

- It’s time for a change

- It’s time for a change

- Kio

- Ottawa

- Art at Navigator

- Navigator Limited Ontario Accessibility Policy

- Virtual Retreat 2020 Closing Remarks

- COVID-19 Resources

- Offices

- Navigator Sight: COVID-19 Monitor

- Navigator Sight: COVID-19 Monitor – Archive

- Privacy Policy

- Research Privacy Policy

- Canadian Centre for the Purpose of the Corporation

- Chairman’s desk

- ELXN44

- Media

- Perspectives

- Podcasts

- Subscribe

- Crisis

- Reputation

- Government relations

- Public affairs campaigns

- Capital markets

- Discover

- studio

- How we win

- What we believe

- Who we are

- Careers

- Newsroom

- AI

- Empower by Navigator

- Environmental responsibility

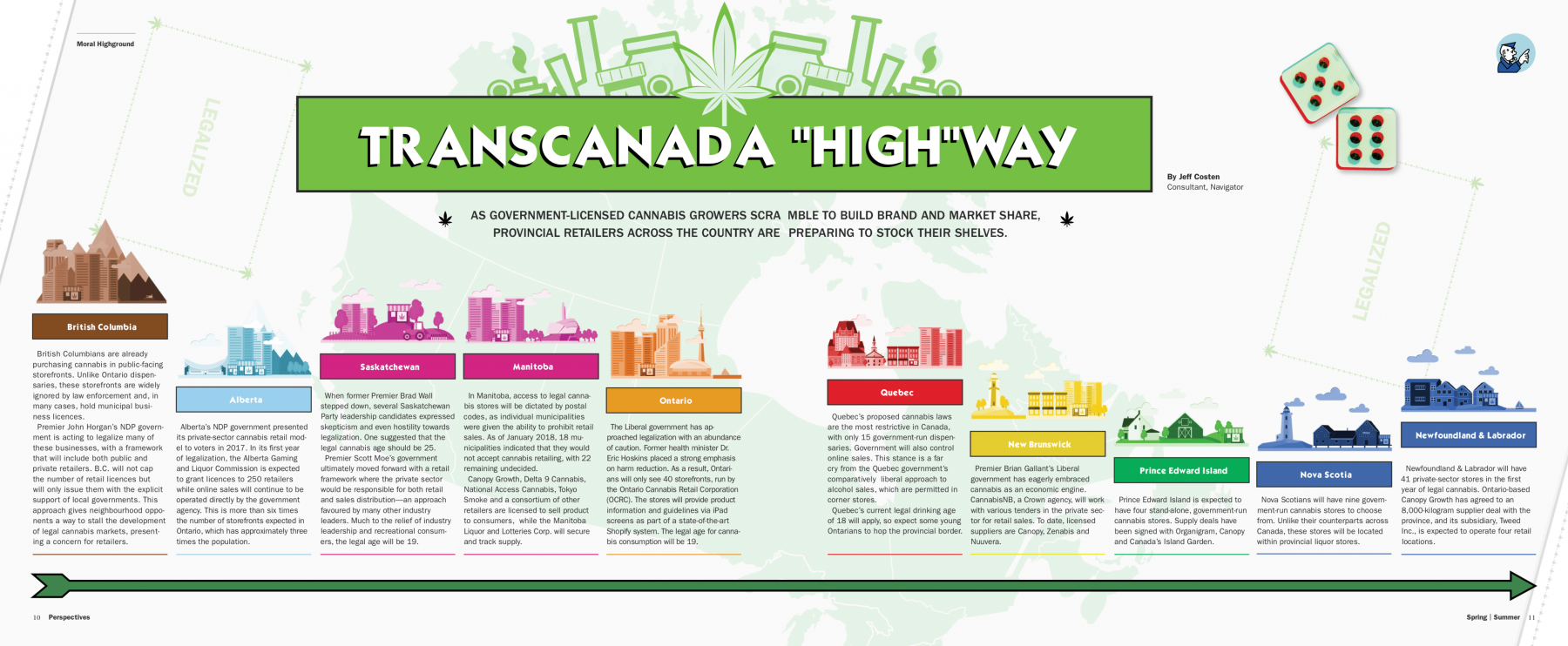

As government-licensed cannabis growers scramble to build brand and market share, provincial retailers across the country are preparing to stock their shelves.

British Columbia

British Columbians are already purchasing cannabis in public-facing storefronts. Unlike Ontario dispensaries, these storefronts are widely ignored by law enforcement and, in many cases, hold municipal business licences.

Premier John Horgan’s NDP government is acting to legalize many of these businesses, with a framework that will include both public and private retailers. B.C. will not cap the number of retail licences but will only issue them with the explicit support of local governments. This approach gives neighbourhood opponents a way to stall the development of legal cannabis markets, presenting a concern for retailers.

Alberta

Alberta’s NDP government presented its private-sector cannabis retail model to voters in 2017. In its first year of legalization, the Alberta Gaming and Liquor Commission is expected to grant licences to 250 retailers while online sales will continue to be operated directly by the government agency. This is more than six times the number of storefronts expected in Ontario, which has approximately three times the population.

Saskatchewan

When former Premier Brad Wall stepped down, several Saskatchewan Party leadership candidates expressed skepticism and even hostility towards legalization. One suggested that the legal cannabis age should be 25.

Premier Scott Moe’s government ultimately moved forward with a retail framework where the private sector would be responsible for both retail and sales distribution—an approach favoured by many other industry leaders. Much to the relief of industry leadership and recreational consumers, the legal age will be 19.

Manitoba

In Manitoba, access to legal cannabis stores will be dictated by postal codes, as individual municipalities were given the ability to prohibit retail sales. As of January 2018, 18 municipalities indicated that they would not accept cannabis retailing, with 22 remaining undecided.

Canopy Growth, Delta 9 Cannabis, National Access Cannabis, Tokyo Smoke and a consortium of other retailers are licensed to sell product to consumers, while the Manitoba Liquor and Lotteries Corp. will secure and track supply.

Ontario

The Liberal government has approached legalization with an abundance of caution. Former health minister Dr. Eric Hoskins placed a strong emphasis on harm reduction. As a result, Ontarians will only see 40 storefronts, run by the Ontario Cannabis Retail Corporation (OCRC). The stores will provide product information and guidelines via iPad screens as part of a state-of-the-art Shopify system. The legal age for cannabis consumption will be 19.

Quebec

Quebec’s proposed cannabis laws are the most restrictive in Canada, with only 15 government-run dispensaries. Government will also control online sales. This stance is a far cry from the Quebec government’s comparatively liberal approach to alcohol sales, which are permitted in corner stores.

Quebec’s current legal drinking age of 18 will apply, so expect some young Ontarians to hop the provincial border.

New Brunswick

Premier Brian Gallant’s Liberal government has eagerly embraced cannabis as an economic engine. CannabisNB, a Crown agency, will work with various tenders in the private sector for retail sales. To date, licensed suppliers are Canopy, Zenabis and Nuuvera.

Prince Edward Island

Prince Edward Island is expected to have four stand-alone, government-run cannabis stores. Supply deals have been signed with Organigram, Canopy and Canada’s Island Garden.

Nova Scotia

Nova Scotians will have nine government-run cannabis stores to choose from. Unlike their counterparts across Canada, these stores will be located within provincial liquor stores.

Newfoundland & Labrador

Newfoundland & Labrador will have 41 private-sector stores in the first year of legal cannabis. Ontario-based Canopy Growth has agreed to an 8,000-kilogram supplier deal with the province, and its subsidiary, Tweed Inc., is expected to operate four retail locations.