- CEOCap

- Jaime Watt’s Debut Bestseller ‘What I Wish I Said’

- Media Training

- The Push Back

- Internship program

- Update Your Profile

- Homepage

- It’s time for a change

- It’s time for a change

- Kio

- Ottawa

- Art at Navigator

- Navigator Limited Ontario Accessibility Policy

- Virtual Retreat 2020 Closing Remarks

- COVID-19 Resources

- Offices

- Navigator Sight: COVID-19 Monitor

- Navigator Sight: COVID-19 Monitor – Archive

- Privacy Policy

- Research Privacy Policy

- Canadian Centre for the Purpose of the Corporation

- Chairman’s desk

- ELXN44

- Media

- Perspectives

- Podcasts

- Subscribe

- Crisis

- Reputation

- Government relations

- Public affairs campaigns

- Capital markets

- Discover

- studio

- How we win

- What we believe

- Who we are

- Careers

- Newsroom

- AI

- Empower by Navigator

- Environmental responsibility

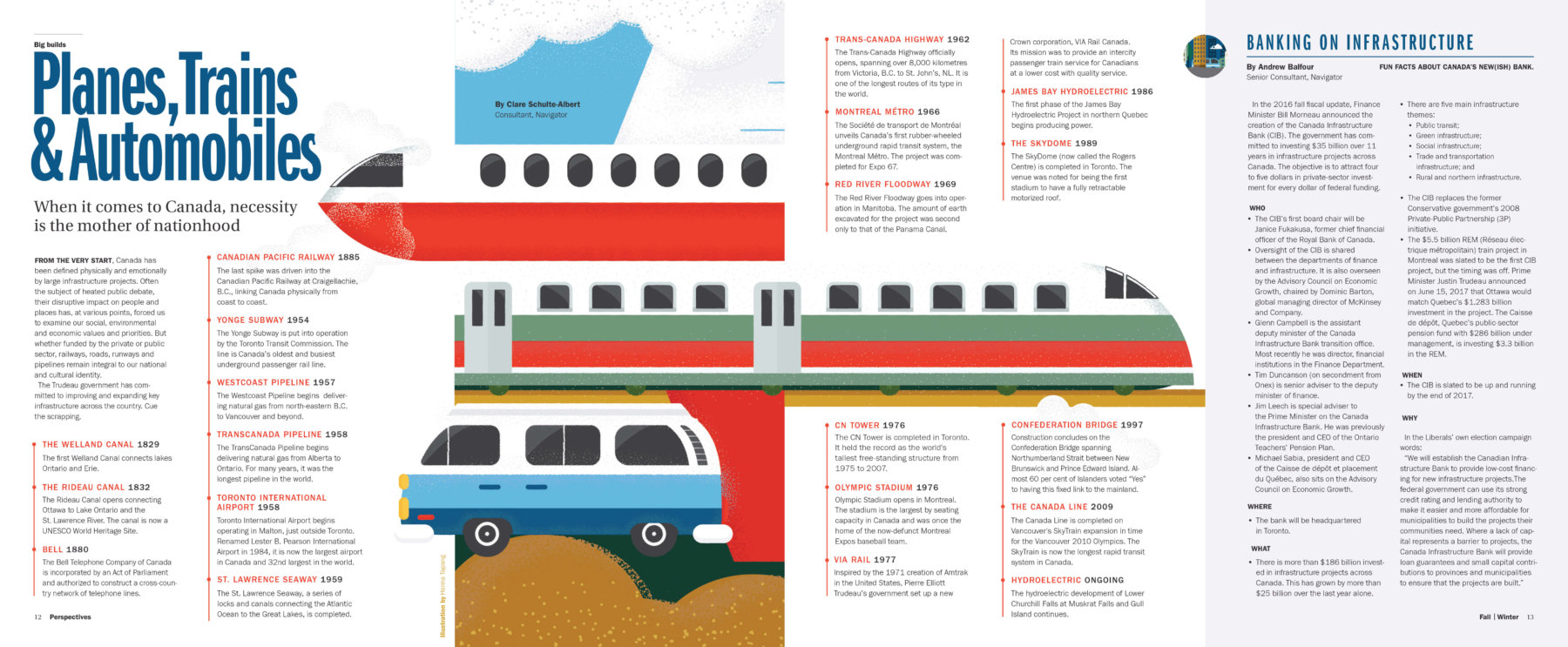

FUN FACTS ABOUT CANADA’S NEW(ISH) BANK.

In the 2016 fall fiscal update, Finance Minister Bill Morneau announced the creation of the Canada Infrastructure Bank (CIB). The government has committed to investing $35 billion over 11 years in infrastructure projects across Canada. The objective is to attract four to five dollars in private-sector investment for every dollar of federal funding.

WHO

- The CIB’s first board chair will be Janice Fukakusa, former chief financial officer of the Royal Bank of Canada.

- Oversight of the CIB is shared between the departments of finance and infrastructure. It is also overseen by the Advisory Council on Economic Growth, chaired by Dominic Barton, global managing director of McKinsey and Company.

- Glenn Campbell is the assistant deputy minister of the Canada Infrastructure Bank transition office. Most recently he was director, financial institutions in the Finance Department.

- Tim Duncanson (on secondment from Onex) is senior adviser to the deputy minister of finance.

- Jim Leech is special adviser to the Prime Minister on the Canada Infrastructure Bank. He was previously the president and CEO of the Ontario Teachers’ Pension Plan.

- Michael Sabia, president and CEO of the Caisse de dépôt et placement du Québec, also sits on the Advisory Council on Economic Growth.

WHERE

- The bank will be headquartered in Toronto.

WHAT

- There is more than $186 billion invested in infrastructure projects across Canada. This has grown by more than $25 billion over the last year alone.

- There are five main infrastructure themes:

• Public transit;

• Green infrastructure;

• Social infrastructure;

• Trade and transportation infrastructure; and

• Rural and northern infrastructure. - The CIB replaces the former Conservative government’s 2008 Private-Public Partnership (3P) initiative.

- The $5.5 billion REM (Réseau électrique métropolitain) train project in Montreal was slated to be the first CIB project, but the timing was off. Prime Minister Justin Trudeau announced on June 15, 2017 that Ottawa would match Quebec’s $1.283 billion investment in the project. The Caisse de dépôt, Quebec’s public-sector pension fund with $286 billion under management, is investing $3.3 billion in the REM.

WHEN

- The CIB is slated to be up and running by the end of 2017.

WHY

In the Liberals’ own election campaign words:

“We will establish the Canadian Infrastructure Bank to provide low-cost financing for new infrastructure projects.The federal government can use its strong credit rating and lending authority to make it easier and more affordable for municipalities to build the projects their communities need. Where a lack of capital represents a barrier to projects, the Canada Infrastructure Bank will provide loan guarantees and small capital contributions to provinces and municipalities to ensure that the projects are built.”