Yesterday, Ontario Finance Minister Peter Bethlenfalvy released the province’s Fall Economic Statement (FES). While the Liberals and NDP criticized the FES for a lack of new initiatives, Tories say the mini budget reflects their core value of fiscal responsibility without compromising key investments for Ontario workers and families. There’s a lot to digest between moving towards a balanced budget and new investments. Don’t worry, we have got you covered:

Fiscally Responsible Ford Government

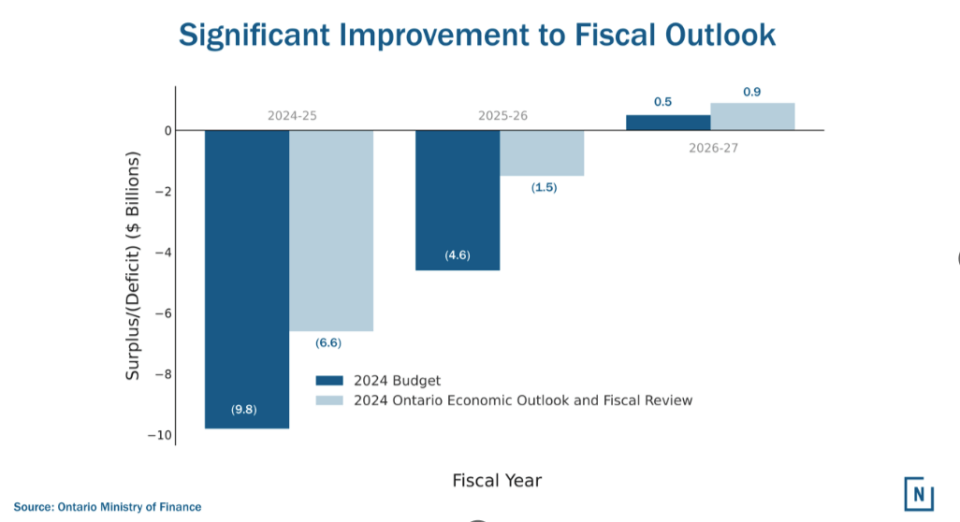

The biggest piece of information: government revenues are up $7 billion, and the government projects a balanced budget in 2026-2027.

With revenue on the rise, the Progressive Conservatives reduced the deficit to $6.6 billion, projecting a balanced budget in 2026, with the option to balance in 2025 ahead of an early election. Provincial revenues are as high as ever, according to the government, with an increase of nearly $60 billion since 2018. The main drivers for this? The government says strong support for businesses, a growing economy and no increases in sales tax.

The FES also provides an update on LCBO’s revenues. While the 2024-2025 figures will result in a slight decline, the government is confident revenues will reach $8.5 billion in 2026-2027, $100 million more than projected in the 2024 budget, despite the expansion of alcohol sales to big box retailers and convenience stores across the province.

The Big Winners

The first pillar of the government’s FES is built on re-investing into Ontario’s economy, specifically highlighting the province’s manufacturing and life sciences sectors. The major announcements within the budget include:

- $94 million as part of Phase 2 of the Life Sciences Strategy;

- An additional $100 million into the Invest Ontario Fund;

- Another $40 million to extend the Advanced Manufacturing and Innovation Competitiveness Stream; and

- Extending and enhancing the Time-Limited tax Relief for the Electricity Distribution Sector until December 31, 2028.

Municipalities get more support

Following the 2024 budget, Ontario’s Big City Mayors commended the government for “listening to municipalities” and addressing infrastructure deficits across the province.

The Ontario government is doubling down on supporting municipalities, with an emphasis on smaller communities.

- $100 million over the next two years to increase the Ontario Municipal Partnership Fund. This is the primary transfer payment from the province to municipalities, giving smaller townships with less income, more funds to operate;

- $1 billion for the new Municipal Infrastructure Program to support projects enabling housing starts in growing communities; and

- Enhancing the Housing-Enabling Water Systems Fund to $825 million.

The province is also prioritizing supporting Ontario taxpayers with direct reimbursements, including tax rebates and cuts, simplifying payment methods for transit, and tying supports to inflation. More specifically, the province is:

- Proposing to provide a $200 taxpayer rebate, for all eligible adult Ontario tax filers, plus an additional $200 for each eligible child under 18 whose families qualify for a Canada Child Benefit payment for 2024;

- Proposing to extend the current temporary gas tax and fuel tax rate cuts keeping the rates at nine cents per liter until June 30, 2025;

- Launching One Fare so transit riders only pay once for transfers between transit systems in the Greater Toronto Area; and

- Expanding the Ontario Guaranteed Annual Income System (GAINS) program and indexing the GAINS benefit to inflation.

Primary care takes primary role

Finally, the province is redoubling its efforts to invest in healthcare, focusing on primary care training, fertility care accessibility and supporting seniors. Specific strategies include:

- Extending Ontario’s Learn and Stay program by providing an additional $17.7 million for 2026-27;

- Expanding the Ontario Fertility Program by $150 million and committing to introduce a new fertility tax credit in 2025;

- Prioritizing access for Ontario residents for medical school seats; and

- Investing $17 million over the next 3 years to support 100 new Seniors Active Living Centres.

Why it matters

- This FES represents the return to a fiscal norm that Tories have been craving, especially after payouts surrounding Bill 124 had inflated Ford’s deficit to higher levels than promised.

- The contents of the FES, especially the $200 taxpayer rebate, are all important incentives for the PC’s to offer voters as they gear up for a potential early election in the spring of next year.

Opposition says FES focused on wrong issues

Liberals

According to Ontario Liberals, Doug Ford is “failing to do his job and address the issues that really matter to Ontario families.” The Liberals did not hold back when commenting on this year’s FES, criticizing the government on two main topics, health care and prioritizing Ontario’s wealthiest.

Liberal Leader Bonnie Crombie focused on Ford’s desire to put “his rich friends first”:

- “Doug Ford is more focused on billion-dollar giveaways to wealthy insiders than he is on fixing health care. People are dying on waitlists, and Doug Ford is spending billions on booze, foreign spas and the Greenbelt scandal.”

This response is consistent with their month-long criticism of Ford’s handling of Ontario’s health care system.

NDP

Similar to the Liberals, the NDP framed Ford’s fiscally focused FES as out-of-touch with the lived realities of everyday Ontarians.

In a statement, Leader of the Opposition Marit Stiles claimed Ontarians “aren’t getting what they paid for,” arguing it is filled with “stale ideas and empty promises.” Specifically, the NDP pointed out the reduced amount of housing starts, delay of transit projects, and lack of supports to address the cost of living as major oversights.