- CEOCap

- Jaime Watt’s Debut Bestseller ‘What I Wish I Said’

- Media Training

- The Push Back

- Internship program

- Update Your Profile

- Homepage

- It’s time for a change

- It’s time for a change

- Kio

- Ottawa

- Art at Navigator

- Navigator Limited Ontario Accessibility Policy

- Virtual Retreat 2020 Closing Remarks

- COVID-19 Resources

- Offices

- Navigator Sight: COVID-19 Monitor

- Navigator Sight: COVID-19 Monitor – Archive

- Privacy Policy

- Research Privacy Policy

- Canadian Centre for the Purpose of the Corporation

- Chairman’s desk

- ELXN44

- Media

- Perspectives

- Podcasts

- Subscribe

- Crisis

- Reputation

- Government relations

- Public affairs campaigns

- Capital markets

- Discover

- studio

- How we win

- What we believe

- Who we are

- Careers

- Newsroom

- AI

- Empower by Navigator

- Environmental responsibility

Understanding how and why politicians make decisions

In the era of what seems to be permanent election campaigning, government decisions more often than not come down to one thing: politics.

Any government’s ideology is an important indicator of its preferred agenda—of the decisions it would like to make. However, for the most part, political leaders will not make decisions or take actions that put them far out of line with public opinion. Rather, in most cases public opinion drives political action.

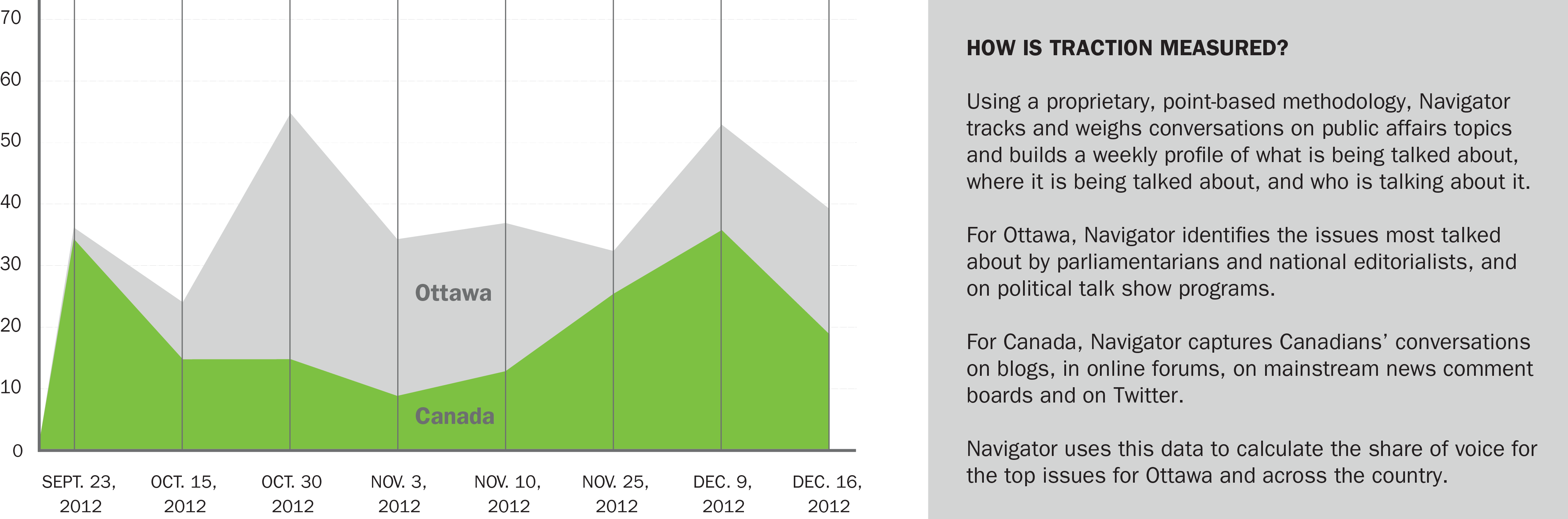

CANADA’S CONVERSATION DROVE POLITICAL ACTION

— Tracking Ottawa and Canada’s reaction to CNOOC and Petronas

Ottawa politicians, pundits and journalists rarely lost focus on the proposed takeover deals. While Canadians moved from one issue to the next—the proposed deals, CSIS, Huawei and trade talks with China—across all issues they were talking about one thing: protecting Canada’s security. Once satisfied that Mr. Harper’s new foreign investment rules would protect security, Canadians moved on.

PUBLIC OPINION AND THE NEW ERA OF FOREIGN INVESTMENT

In December 2012, Prime Minister Stephen Harper announced new rules to govern foreign investment in Canada. On the surface, Mr. Harper was announcing changes to Canada’s Investment Act. More importantly, however, taking a deeper look at Canadians’ conversation leading up to his announcement, it is clear that Mr. Harper was taking political action in response to public opinion.

Announcing the new rules, Mr. Harper’s message was clear: Canada is open for business, but not for sale. Understanding the Canadian conversation leading up to his announcement reveals why Mr. Harper chose his message.

For months prior to the announced changes in the Investment Act, media coverage focused on the proposed purchase of Nexen by state-owned Chinese company CNOOC and Progress Energy by Malaysian state-owned company Petronas. Journalists and pundits wondered whether Mr. Harper and his government would approve the sales. Canadian public opinion, though, was more nuanced in its concern.

Canadians understood the value of foreign investment and its economic merit; they knew foreign investment would promote economic development and job creation. However, Canadians were uneasy with the idea of state-owned companies having nearly limitless access to Canada’s resource sector. At the outset of the announced transactions, the opposition saw and seized the opportunity, and strategically pitted two key strengths of Mr. Harper and his government—economic stewardship and national security—against one another.

Ensuing developments didn’t help Mr. Harper’s dilemma.

CSIS, Canada’s spy agency, raised security concerns about foreign takeovers by state-owned companies, and in doing so provided further proof to help confirm Canadians’ suspicions.

Mere weeks later, news broke that the Canadian government was being investigated for putting North American safety at risk by permitting Chinese-based technology company Huawei to participate in major Canadian telecommunications projects. While barred by the U.S. and Australia, Huawei was making inroads in the Canadian market. Canadians made a connection between Huawei security concerns and foreign state-owned investments.

Amid CSIS warnings and news that Huawei could threaten Canada’s telecommunications system, Canadians’ anxiety about threats to national security came to define their understanding of foreign investment by state-owned enterprises.

Public opinion had shifted; Harper could no longer afford to approve the Nexen and Progress Energy deals without political action that effectively responded to Canadians’ concerns.

In the end, the proposed deals were approved, but Mr. Harper effectively responded to public opinion by raising the bar for future bids by state-owned foreign companies. By changing the rules, Mr. Harper created a new era of foreign investment governed largely by a single rule for companies: without the ‘social licence’ to proceed, don’t even consider bidding.

ON THE SENATE, HARPER TAKES HIS CUES FROM CANADIANS

For much of the final months of 2013, ongoing Senate scandals rocked Ottawa and dominated headlines. As far as Canadians were concerned, the scandals were by and large the only thing worth discussing. As their conversation persisted, Canadians began to demand action.

Canadians will not move on from scandals—including the Senate scandals—until a cogent and believable explanation has been

offered and action has been taken to ensure accountability. But what should this action look like? On the Senate, Canadians gave Mr. Harper clear instructions.

Senators Pamela Wallin, Mike Duffy and Patrick Brazeau had already been ousted from the Conservative caucus, but in October 2013, the government announced its intention to remove all three from the upper chamber without pay for ‘gross negligence.’

Before announcing its intention in October 2013, for a brief time the government indicated it was potentially open to more lenient punishments for Senators Wallin and Brazeau. Mr. Duffy, however, was always to face the strictest sentence. Mr. Harper wanted him as far from Parliament Hill as possible.

When the Senate scandal first broke, the conversation among Canadians focused on the Senate and the Prime Minister’s Office (PMO). However, as further details became known and after Mr. Duffy lashed out at Mr. Harper and his office, the conversation quickly shifted away from institutions and toward personalities: Canadians were beginning to point their fingers squarely at the Prime Minister and his 2008 Senate appointee.

Mr. Harper understood that he had to take extreme action or his leadership would be forever linked with Mr. Duffy’s financial irregularities. Whatever the short-term political pain or caucus fallout, the baggage had to be dropped. A few weeks later, all three senators were suspended from the Senate.

For weeks, NDP Leader Thomas Mulcair relentlessly and effectively attacked the government’s Senate scandal explanation during Question Period. Those attacks forced the Prime Minister to take clear positions on who he felt was guilty of any misdeeds—positions that, if rebuked by further investigations, could spell political disaster. However, up to this point, Mr. Harper has skirted contradictions and Canadians have not rewarded Mr. Mulcair for his stint as ‘lead prosecutor’ in the House of Commons.

Public opinion can drive action and it can drive inaction: understanding that he would have to score political points elsewhere, Mr. Mulcair has put Mr. Harper on the record and has moved on to other issues.

Meanwhile, Canadians applauded Justin Trudeau’s bold move to force senators who had been sitting as Liberals to now sit as independents. What Trudeau didn’t do, however, was drive a direct contrast with the government. Trudeau’s Senate surprise may have boosted the Liberal brand, but it didn’t further drive down the Conservatives’. To win the battle over accountability, Mr. Trudeau will have to do both.

After months of shifting explanations and endless revelations, the government’s goal now is to shift attention away from questions of accountability and fight the next election on more comfortable footing. Mr. Harper and his government will push an aggressive agenda. Moving forward, the economy will be central to almost everything Mr. Harper and his caucus says and does; free trade, jobs programs, budgetary restraint, economic mobility, immigration reform, pipelines, procurement and tax relief will drive a competing narrative.